Thanks to the Nixon Tapes from the White House, we have a looking glass that gives great insight into Nixon’s true thoughts and feelings - and how they differ markedly from what he said publicly.įor instance, despite calling himself a Keynesian, he was also a monetarist - at least to the extent he thought it might help him get elected in 1972. Butkiewicz of the University of Delaware, Nixon knew it. In reality, Nixon was doing the exact opposite, and, according to an analysis by Burton A. “We will press for the necessary reforms to set up an urgently needed new international monetary system.” He then goes on to declare, “I am taking one further step to protect the dollar, to improve our balance of payments, and to increase jobs for America.” So, Tricky Dick (as he was known in politics) presented himself as a protector of the dollar, a warrior against inflation, and a jobs creator. Note the sense of urgency he is creating with his language. The American dollar was a “ hostage in the hands of international speculators“? Hmmm.

On 15 August 1971, President Nixon announced to the world that the United States was closing the gold window in a move known as the Nixon Shock.

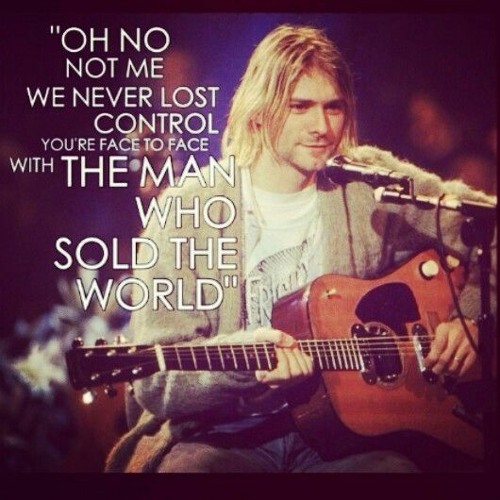

What happened? How did we get from there to here? And what lessons can we draw from this relatively recent economic history to inform where we should be going? Tracing the history of this gold standard and its demise ultimately led me to one man - US President Richard Milhous Nixon - the man who untethered the cord linking currencies to gold the man who sold the world fiat money. Of course, the world used to be on a type of gold standard known as the Bretton Woods Agreement. Yet each of these problems could be tamed and mollified, in my view, with a true gold standard.

Today, the United States lives with federal budget deficits of more than $1 trillion each year, interest rates that are artificially held below market levels, aggregate debt that is growing much faster than the economy, and a chronic trade deficit that is larger than whole industries.

0 kommentar(er)

0 kommentar(er)